In the November 2025 elections, energy affordability was a top-priority issue for voters nationwide, who are feeling the pressure of rising energy bills. It was a central theme in the elections in Virginia, New Jersey, and Georgia, and Virginia’s new Governor-elect Abigail Spanberger highlighted lower energy bills among the three priorities in the Affordable Virginia Plan on which she campaigned, alongside healthcare and homeownership.

Over the past year, Virginia has been considering how alternative regulatory approaches could help better align utility performance with state policy goals including affordability as well as energy efficiency, decarbonization, and others. In doing so, Virginia is now one of several states exploring performance-based regulation, or “PBR,” as a path to incentivize utilities to align their performance with these and other desired state policy outcomes.

GPI, in partnership with Current Energy Group (CEG), recently authored a report, Opportunities for Performance-Based and Alternative Regulatory Tools in Virginia, highlighting how PBR could better incentivize Virginia’s electric utilities to align their performance with such policy goals.

Improving energy affordability—of growing interest and attention nationwide due to concerns related to rising electricity prices—is a primary desired outcome of PBR frameworks and is an area of focus the report. The report explores ways in which PBR could achieve improved energy affordability in Virginia, as well as improved alignment with other policy areas of interest including energy efficiency and decarbonization.

What is performance-based regulation (PBR)?

Traditional utility ratemaking practices authorize utilities to recover costs associated with business operations and capital expenditures. They also allow utilities to earn an approved rate of return (profit) on top of capital costs. Critics of the traditional model argue that it biases utilities toward making capital investments, on which they receive a guaranteed rate of return, over containing costs.

PBR offers an alternative to this model. Under a PBR approach, the regulator incentivizes the utility to achieve desired outcomes by tying cost recovery and earnings opportunities to the utility’s actual performance. Accordingly, PBR is commonly explored as a way to incentivize utilities to contain their spending to the extent feasible, while still fulfilling their obligation to provide safe and reliable service.

Performance-Based Regulation: Harmonizing Electric Utility Priorities and State Policy

Virginia’s Exploration of PBR

In March 2024, the Virginia General Assembly passed a joint resolution, with bipartisan support. The resolution directed the Virginia Department of Energy to conduct a stakeholder engagement process to gather perspectives on PBR and other alternative regulatory tools for electric utilities in Virginia. It also directed the State Corporation Commission (SCC) to prepare a study evaluating “the potential of performance-based regulatory tools and alternative regulatory tools to assist in the regulation of investor-owned electric utilities,” focusing on several specific performance areas.

The Virginia SCC selected GPI and CEG to write the PBR study, with technical research support provided by Pacific Northwest National Laboratory.

Participant perspectives included both support for Virginia’s existing regulatory model and support for comprehensive PBR reform. However, a majority of participants indicated support for increased use of PBR mechanisms as a means to further align utility incentives with Virginia’s policy goals, including affordability, efficiency, and decarbonization.

Here we highlight two pathways through which PBR could support Virginia’s progress towards achieving these goals, as described in the report. Additional recommendations from the report are listed below.

Minimize the extent to which utility costs are recovered via rate adjustment clauses

Electricity costs in Virginia are comparable to peer states and, like those states, are trending upward. Somewhat unique to Virginia, however, is the extent to which many of these costs are contained within rate adjustment clauses (RACs) (commonly referred to as “riders” or “trackers” in other states).

Riders are additional charges on customers’ bills through which utilities recover specific costs not contained in customers’ base rates. They can be a helpful tool to guarantee cost recovery where utilities’ actions align with a state policy priority, such as energy efficiency. Their limited use can also be appropriate for recovering costs that are not substantially within utility control, such as fuel costs, because they minimize the risk of not recovering such costs.

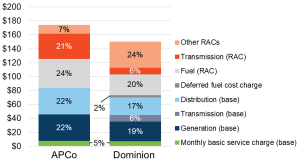

In Virginia, however, there is a heavier reliance on riders, or RACs, than is common in other states. As a result, a significant portion of Virginia electric utilities’ costs are collected outside residential customers’ base rates via RACs, as shown in the figure below.

Cost components of a typical monthly residential electricity bill in Virginia (1,000 kWh consumption) in 2025

Sources: Figure by GPI and CEG with assistance from PNNL, republished from Opportunities for Performance-Based and Alternative Regulatory Tools in Virginia, figure 6, based on data from Appalachian Power Company, Select Schedule Charges and Associated Rider Charges, January 1, 2025; Dominion Energy, Schedule 1 Residential Service, August 4, 2024.

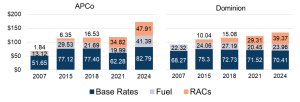

Furthermore, for both Virginia’s regulated electric utilities (Dominion and APCo), the portion of residential customers’ bills consisting of RACs has grown significantly between 2007 and 2024, while base rates have remained more stable.

Historical cost components of typical monthly residential electricity bill in Virginia (1,000 kWh consumption, summer month)

Source: Figure by GPI and CEG, republished from Opportunities for Performance-Based and Alternative Regulatory Tools in Virginia, figure 7, adapted from Commonwealth of Virginia SCC, Status Report: Implementation of the Virginia Electric Utility Regulation Act (November 1, 2024), 4, 7.

For the same reasons why RACs can be helpful to recover costs that fall outside of utility control, overuse of RACs can “shield” the utility from risks associated with imprudent investment decisions. This is especially true in instances in which a utility has more control over costs, such as grid investments. Some costs that Virginia electric utilities currently recover via RACs could instead be subject to more prudency review and oversight if they were removed from the RAC cost recovery framework. Stronger incentives for cost control through a PBR framework would further encourage utilities to make thoughtful investments in alignment with state policy goals, recognizing that their ability to recover those costs would be subject to greater oversight than when embedded within RACs. In a period of increasing electricity costs, this is an important consideration with respect to customer affordability.

Consider fuel cost-sharing to incentivize prudent utility fuel purchasing and decarbonization

Similarly, alternative approaches to fuel cost recovery present a pathway through which a PBR model could incentivize Virginia’s electric utilities to contain fuel costs, leading to improved affordability.

A fuel cost-sharing mechanism is a tool by which regulators can incentivize utilities to make more thoughtful investments when it comes to fuels (and the extent to which they depend on them). This mechanism—common in PBR frameworks—shares the fuel cost burden between the utility and its customers.

This cost-sharing mechanism differs from more traditional models in which fuel costs are directly “passed through” to customers via a RAC, meaning what the utility pays for fuel to generate electricity is directly passed through to the utility’s customers. Fuel cost-sharing mechanisms also encourage utilities to ensure that fuel purchases are prudent and to explore approaches that minimize fuel use to the extent feasible (e.g., through efficiency programs and renewable resources) because under such a model, the utility also bears financial risk associated with its fuel purchases. In Virginia and commonly nationwide, fuels remain “pass-through” costs that are recovered via RACs. On average, these constitute a significant portion of Virginia residential customers’ electricity bills: approximately 18 percent for Dominion customers and approximately 24 percent for APCo customers in 2024.

In states with renewable deployment and energy efficiency goals like Virginia, fuel costs should theoretically decrease over time as utilities’ generation portfolios become less reliant on purchased fuels (e.g., coal and natural gas) and more reliant on fuel-free renewable resources (e.g., solar and wind) and expanded energy efficiency. However, fuel costs in Virginia have remained relatively stable or even increased, depending on the utility.

Fuel costs have historically been recovered via RACs because they have been considered to be outside of the utility’s control due to broader market conditions and price volatility. However, utilities are increasingly able to control the extent to which they must rely on fuels purchased from the broader market.

For example, utilities can develop a generation portfolio that is less reliant on fuel-powered generation, such as by expanding the portion of their portfolio that uses renewable resources. By limiting or reducing reliance on cost-volatile fuels for electricity generation, Virginia’s electric utilities have an opportunity to reduce the extent to which customers are burdened by fuel costs while also improving alignment with Virginia’s decarbonization goals.

Additional recommendations from the PBR report

In addition to recommending that Virginia consider reducing its use of RACs and adopting a fuel-cost sharing mechanism, GPI and CEG’s report also recommends that Virginia decision makers consider additional strategies to better align electric utility performance with state policy goals. Additional recommendations, presented as considerations for Virginia decision makers, include the following:

- Improving utilities’ incentives to achieve Virginia’s renewable portfolio standards (RPS)

- Adoption of an all-source competitive procurement framework for generation resources, which can have lower costs than utility built, owned, and operated resources.

- Possible development of a more comprehensive, integrated PBR framework that would further align utility performance incentives with state policy goals.

In addition, the report recommends that Virginia place affordability and cost containment at the center of all regulatory decisions, including but not limited to its consideration of PBR. These recommendations offer pathways through which a PBR model could incentivize electric utility alignment with established policy goals.

Next steps for Virginia

On October 15, the SCC submitted GPI and CEG’s report to the Virginia General Assembly and the Governor. The report is available on the Virginia General Assembly website and is filed in SCC Case No. PURA-2024-00152, In the matter concerning performance-based regulation and alternative regulatory tools for investor-owned electric utilities.

Future action on the findings and recommendations identified in GPI’s and CEG’s PBR study for the SCC is open for consideration by the Virginia General Assembly, SCC, and stakeholders in Virginia.

If you’re interested in learning more or have questions about PBR and other utility regulation subjects, please reach out to us: Aileen Cole (GPI) and Dan Cross-Call (Current Energy Group).